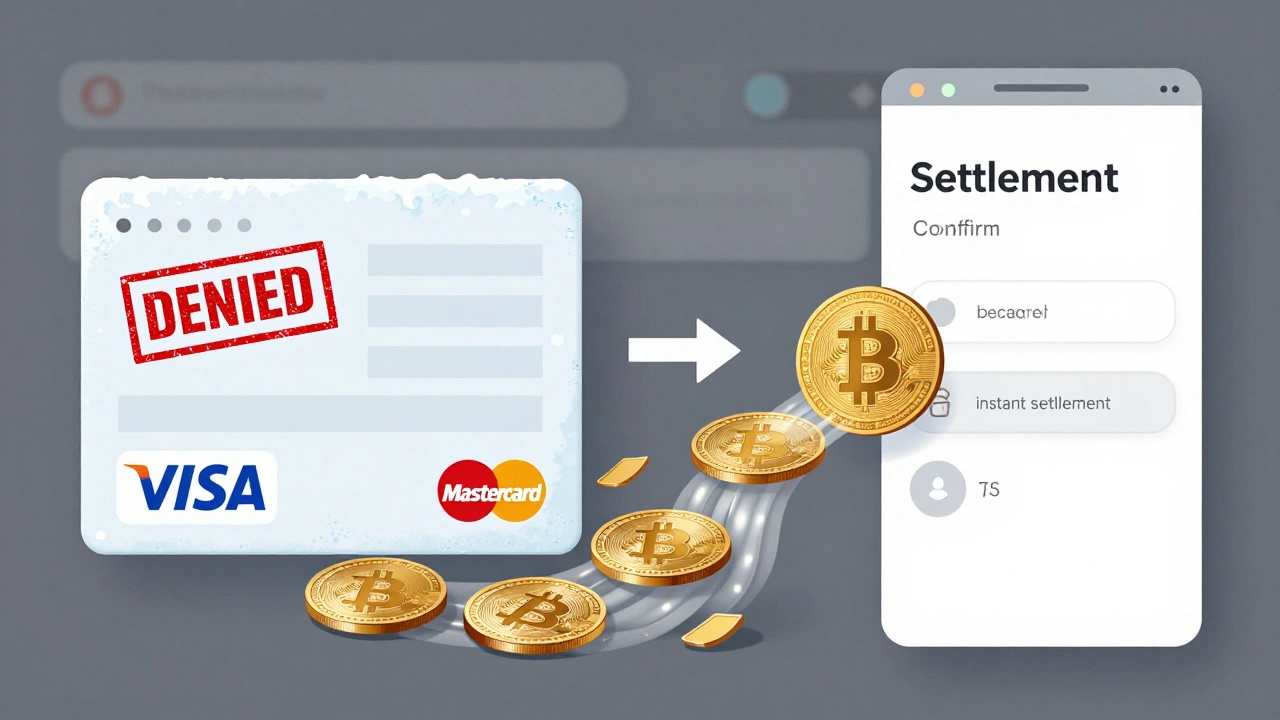

Running an adult business isn’t just about creating content-it’s about getting paid. And that’s where things get messy. Most banks and payment processors won’t touch adult-related businesses. Even if you’re legal, compliant, and doing everything right, your card payments might get blocked, your funds frozen, or your account shut down overnight. This isn’t theoretical. In 2025, over 60% of adult content creators reported at least one payment disruption in the past year, according to a survey by the Adult Industry Financial Alliance. If you’re trying to run this kind of business without knowing the right payment tools, you’re gambling with your income.

Why Adult Businesses Are Classified as High-Risk

It’s not about legality. It’s about perception. Payment networks like Visa and Mastercard label adult businesses as high-risk because of chargeback rates, regulatory uncertainty, and public stigma. Chargebacks happen when a customer disputes a charge-often claiming they didn’t authorize it or forgot they subscribed. In adult businesses, chargebacks can be 5 to 10 times higher than in other industries. A typical e-commerce store might see a 0.5% chargeback rate. Adult businesses? It’s not uncommon to hit 5% or more.

Plus, some banks don’t want their names associated with adult content, even if it’s legal. That’s why you can’t just open a regular business account with Chase or Bank of America. They’ll close it the moment they find out what you do. This forces adult businesses into a narrow lane of specialized payment processors who accept the risk-and charge more for it.

Typical Fees You’ll Pay

If you’re used to paying 2.9% + $0.30 per transaction like on Shopify or PayPal, prepare for a shock. Payment processors for adult businesses charge between 5% and 9% per transaction. That’s double or even triple what most businesses pay. Here’s what you’re actually paying for:

- Higher processing fees: 5.5%-8.5% per transaction, depending on volume and processor

- Monthly minimums: $50-$200, even if you don’t hit that volume

- Setup or application fees: $100-$500 one-time cost to get approved

- Reserve requirements: 10%-20% of monthly sales held as a rolling reserve for 6-12 months

- Early termination fees: $1,000-$5,000 if you switch processors before contract ends

These aren’t hidden fees. They’re standard. But they add up fast. A creator making $20,000 a month in sales could pay $1,600-$2,400 in fees alone-before taxes, hosting, or staff.

Common Risks Beyond Fees

Fees are annoying. The real danger is losing access to your money.

One major processor, Clearinghouse Payments, shut down a subscription-based adult site in late 2024 after a single customer dispute triggered a chargeback wave. The business had $87,000 in pending payouts. They got zero. No warning. No appeal process. Just a notice: “Account terminated due to violation of acceptable use policy.”

Other risks include:

- Account freezes: Your funds can be locked for weeks while they investigate

- Bank closures: If your bank finds out, they can shut down your entire business account

- Payment gateway bans: Even if you use Stripe or PayPal, they may ban you retroactively if they discover your business category

- Reputation damage: If your processor gets blacklisted, future processors will refuse you

The key? Never rely on one payment method. Diversify or risk total shutdown.

Best Payment Processors for Adult Businesses in 2026

Not all processors are equal. Some are built for adult businesses. Others just tolerate them. Here are the top three that actually deliver:

1. Payza (formerly Payza)

Payza has been around since 2008 and specializes in adult, dating, and subscription services. They offer:

- 6.2% per transaction

- No monthly minimum

- 7-day payout cycle

- Reserve capped at 10%

- 24/7 support with real humans who understand adult business needs

They’ve processed over $2.1 billion for adult businesses since 2020. Their biggest downside? They don’t support direct bank transfers-only e-wallets and crypto.

2. Merchant Services Group (MSG)

MSG is one of the few processors that still offer traditional merchant accounts for adult businesses. That means you can accept credit cards directly, not just through e-wallets.

- 5.8% per transaction

- 15-day rolling reserve (reduced after 6 months of clean history)

- Direct ACH deposits to your bank

- Custom fraud filters for subscription models

- Contract length: 12 months

MSG is ideal if you want to avoid third-party wallets and keep funds in your own bank. But they require a business license, tax ID, and a detailed compliance plan.

3. Crypto-based Processors (BitPay, CoinGate)

Crypto is becoming the quiet hero of adult business payments. No chargebacks. No bank interference. No middlemen.

- 1.5%-2.5% per transaction

- No reserves

- Instant settlement

- No KYC beyond basic wallet address

BitPay and CoinGate now support automatic conversion to USD or EUR, so you don’t have to hold crypto. A 2025 study by the Digital Payments Institute found that 38% of adult businesses now use crypto as their primary payment method. It’s growing fast.

What to Avoid

Stay away from these:

- PayPal: They ban adult businesses and freeze funds without warning

- Stripe: They don’t allow adult content, even if it’s legal

- Square: Their terms explicitly prohibit adult services

- Any processor that doesn’t disclose fees upfront: Hidden costs will ruin you

- Processors that don’t offer dispute support: If you can’t fight chargebacks, you’ll bleed money

If a processor says, “We don’t comment on what businesses we accept,” walk away. Transparency matters.

How to Stay Safe and Keep Getting Paid

Here’s what works:

- Use multiple processors: Don’t put all your eggs in one basket. Use one for credit cards, one for crypto, one for e-wallets.

- Document everything: Keep records of all content, consent, and billing disclosures. This helps if you need to fight a chargeback.

- Use clear billing descriptors: Your customers should see “MySite.com” on their statement-not “NSFW Adult Club.”

- Require two-factor consent: Make users confirm subscriptions twice. This cuts chargebacks by up to 60%.

- Monitor chargeback patterns: If one customer files three disputes in a month, block them.

One creator in Portland started using BitPay for 70% of payments and Payza for the rest. In 18 months, she had zero frozen funds and reduced her monthly fees by 40%. She didn’t need a fancy website-just smart payment choices.

What’s Next for Adult Business Payments?

The industry is shifting. More banks are starting to accept adult businesses if they’re fully compliant. Some are even offering dedicated accounts with lower fees. Meanwhile, crypto adoption keeps climbing. By 2027, experts predict over half of adult businesses will use blockchain-based payments as their primary method.

But until then, the rules are harsh. You have to be smarter than the banks. You have to be more organized than the chargeback systems. And you have to choose your payment partners like you choose your security software-carefully, deliberately, and with backup plans.

There’s money in adult content. But it’s not handed to you. You have to fight for it-and the right payment processor is your first weapon.