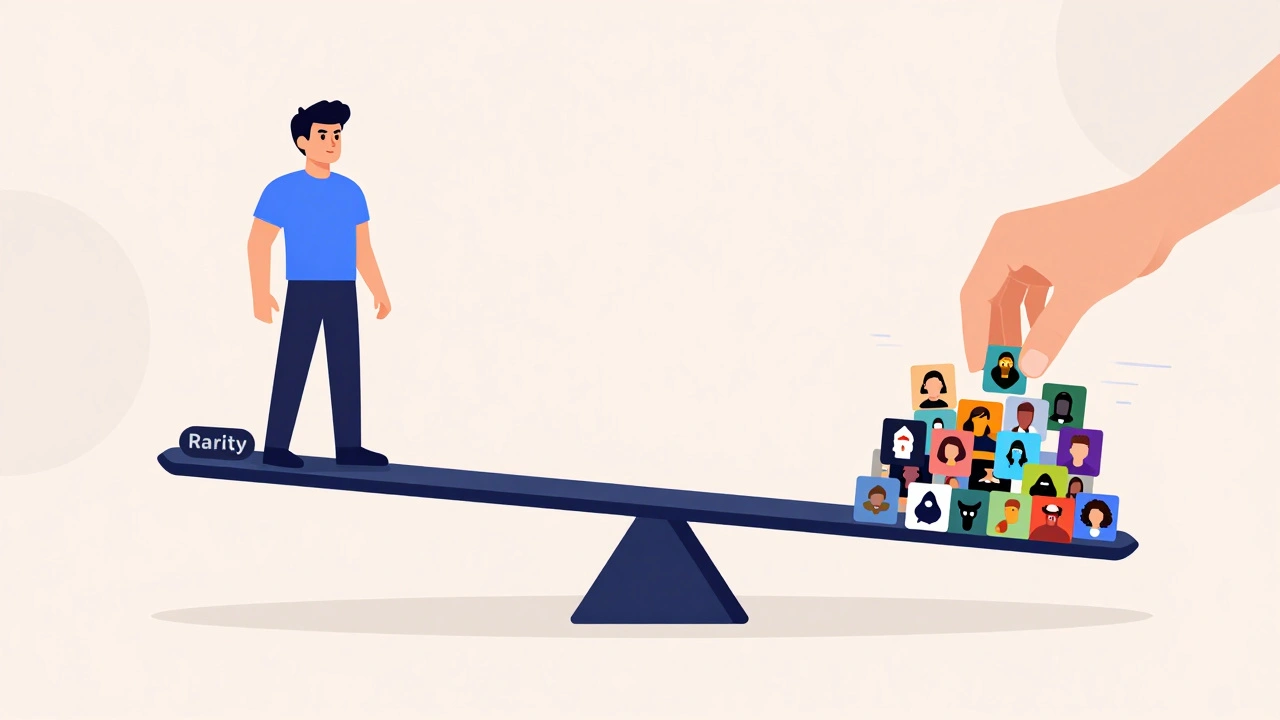

Ever bought a rare video game skin or NFT hero, only to find out you can’t sell it without taking a huge loss? You’re not alone. In the world of digital collectibles, rarity doesn’t always mean profit. Sometimes, the rarer something is, the harder it is to turn it into cash. That’s where liquidity comes in - and why understanding the difference between rarity and liquidity is the key to selling thinly traded game titles without getting stuck.

Why Rarity Can Be a Trap

Rarity sounds like a golden ticket. A Covert-tier CS2 skin, a Legendary hero in a P2E game, or a limited-edition NFT from a defunct blockchain title - these items are prized for being hard to find. But here’s the catch: if no one else is buying, your rare item is just a digital decoration. The market for these items is thin. That means few buyers, wide bid-ask spreads, and long wait times. One study of CS2 skin markets showed that Covert-tier items (the rarest) trade less than 5% as often as Mil-Spec or Restricted skins. Even if your skin is worth $2,000 on paper, you might only get $800 if you need cash fast.And it gets worse. Game updates kill demand overnight. A new patch that changes weapon mechanics can make a once-coveted skin look outdated. E-sports tournaments boost demand for specific skins - until the tournament ends. Then, prices crash. Rarity doesn’t protect you from these shocks. In fact, it makes you more vulnerable. With fewer buyers, there’s no one to absorb the price drop. You’re left holding an asset that’s harder to move than a brick.

Liquidity Isn’t Just About Volume - It’s About Speed

Liquidity isn’t about how many people are trading. It’s about how fast and how cleanly you can sell. A Consumer Grade CS2 skin might only sell for $2, but it sells every 12 seconds. That’s liquidity. You list it at 11 a.m., you get paid by noon. No haggling. No waiting. No guessing.Mid-tier items - like Restricted or Mil-Spec skins - are the sweet spot. They’re not common enough to be boring, but common enough to have real buyers. Studies show that AI-driven trading bots favor these items because they offer the best balance: decent value, fast turnover, and predictable price movement. These skins move consistently, even during market dips. That’s why experienced traders don’t chase the rarest items. They chase the most tradable ones.

Think of it like a used car market. A rare 1967 Mustang might be worth $100,000 - but if you need to sell it next week, you’ll take $70,000 and be happy. A 2018 Honda Civic might only be worth $15,000, but you can sell it in 24 hours at asking price. In gaming assets, the Civic is the Restricted skin. The Mustang is the Covert skin. One gives you speed. The other gives you hope.

How Blockchain Games Make Liquidity Worse

Blockchain games promised decentralized ownership - but many made liquidity worse. Take Axie Infinity. At its peak, players made $500 a month just by playing. Then the economy collapsed. Why? Because the game flooded the market with Smooth Love Potion (SLP) tokens. No scarcity. No control. The token’s value dropped 99.1%.Even worse, some games let players mint their own NFTs. In The Sandbox, anyone can create a new piece of land or item. Suddenly, your “unique” digital building isn’t rare anymore - it’s one of 500 similar versions. Scarcity isn’t enforced by the blockchain. It’s enforced by the game’s rules. And many developers don’t care enough to enforce them.

That’s why NFTs from games with fixed supplies, active user bases, and controlled releases perform better. Games like Splinterlands or Gods Unchained have clear rarity tiers, slow asset minting, and burn mechanics that remove old items from circulation. These systems preserve scarcity - and keep liquidity alive.

Portfolio Size Changes Everything

If you’re selling one rare item, you’re at the mercy of the market. But if you own 500 items? Your strategy changes.Smaller collections are dominated by common items - Consumer and Industrial Grade. They’re cheap, easy to sell, and keep your cash flowing. But as your portfolio grows, you can afford to hold higher-rarity items. Why? Because you’re no longer relying on one sale. You’re spreading risk. A portfolio of 1,000+ assets can sustainably hold Covert skins and Legendary heroes. The volume of trades across your collection creates enough demand to keep prices stable.

Think of it like a stock portfolio. You wouldn’t put all your money in one IPO. You diversify. Same here. A large collection can afford to wait. A small one can’t.

When to Sell - and When to Wait

Here’s the real-world rule: If you need cash in the next 30 days, sell liquid items first. Don’t try to flip a Covert skin in a week. You’ll lose 30-50% of its value.Instead, list your Restricted and Mil-Spec skins. They’ll sell fast. Use that cash to buy more liquid assets, or hold them until market conditions improve.

If you’re not in a rush - and you have the capital - then yes, hold rare items. But only if:

- The game is still active (check monthly players, not just hype)

- The developer has a clear scarcity policy (no random NFT drops)

- You own multiple items from the same rarity tier (to create your own mini-market)

Many collectors lose money because they treat rare items like gold. They’re not. They’re more like limited-edition sneakers - valuable only if someone wants them right now.

What to Look for Before You Buy

Before you spend money on a rare game asset, ask these questions:- How many of these items are in circulation? (Use marketplace filters - don’t trust seller claims)

- How many trades happened in the last 30 days? (If it’s under 10, it’s too thin)

- Is the game still receiving updates? (No updates = dead market)

- Is the asset tied to a competitive mode? (Skins used in tournaments hold value longer)

- Does the game burn or lock items? (This prevents inflation and supports scarcity)

Ignore the hype. Ignore the “only 3 in existence” claims. Check the data. A skin with 12 trades last month is more valuable than one with 1 trade - even if the latter costs 10x more.

Bottom Line: Liquidity Wins in the Long Run

Rarity gets attention. Liquidity gets paid. The most successful traders aren’t the ones who own the rarest items. They’re the ones who know when to sell, what to sell, and how to keep their cash flowing.If you’re holding a thinly traded title, don’t wait for a miracle buyer. List your liquid assets first. Use the cash to buy more tradable items. Build volume. Wait for the right moment. And remember: in gaming markets, the best investment isn’t the rarest item. It’s the one you can actually sell when you need to.

Can I sell a rare video game item without losing money?

Yes - but only if you’re patient and have other liquid assets to trade with. Rare items often have wide bid-ask spreads, meaning buyers offer far less than sellers ask. To avoid a loss, list your item at market price (not your purchase price) and wait for a buyer. Meanwhile, sell more liquid items to cover immediate needs. Never force a sale on a rare item - you’ll likely take a 30-60% loss.

Are NFTs from blockchain games a good investment?

Most aren’t. The blockchain gaming market crashed after 2022 because too many games flooded the market with tokens and NFTs without controlling supply. Only games with fixed supplies, active player bases, and burn mechanics (like Splinterlands or Gods Unchained) have held value. Avoid games that rely on new player recruitment to sustain prices - those are Ponzi-like economies. Look for games that have been around for 2+ years and have stable tokenomics.

What’s the best rarity tier to trade for consistent profits?

Restricted and Mil-Spec tiers offer the best balance. They’re valuable enough to make a profit, but common enough to sell quickly. In CS2, these tiers make up 70% of all trades. In P2E games, Epic heroes (not Legendary) trade the most. AI trading bots target these tiers because they have low volatility, high turnover, and predictable demand. Avoid Consumer Grade (too cheap) and Covert/Legendary (too illiquid) unless you’re holding long-term.

Do game updates affect the value of my items?

Constantly. A patch that changes weapon balance, removes a skin from rotation, or alters how rewards work can tank prices overnight. For example, when Valve changed the CS2 case system in 2023, some rare skins dropped 40% in value within days. Always check patch notes before holding onto an item. If a skin is no longer obtainable or used in gameplay, its value drops fast - even if it’s rare.

How do I know if a game’s economy is sustainable?

Look at three things: 1) Monthly active users (MAU) - if it’s under 10,000, the market is too small. 2) Token supply - if new tokens are being minted faster than burned, inflation is coming. 3) Developer transparency - do they publish supply data? Do they lock or burn items? Games like Axie Infinity failed because they printed tokens endlessly. Games like RuneScape or Counter-Strike 2 succeed because they control supply tightly. If the developer doesn’t talk about scarcity, assume it’s not being managed.